Venmo 101: The Fees, Limits & Fine Print You Need to Know About

Thanks to its intuitive interface that makes sending and receiving money a breeze, Venmo has become the go-to app for millions in the US. In fact, you've probably heard the term "Venmo you" being tossed around between friends. But before you take the plunge and sign up, it's always a good idea to read the fine print and know what you're getting into. Money is involved, after all.Though Venmo's user agreement is easy enough to understand through careful reading, there are little details within it that are worth paying special attention to. There are also imposed limits you need to be fully aware of, along with other regulations and important tidbits that are not explained in the user agreement.Don't Miss: How to Send Money on Venmo Using the iPhone's Messages App Understanding these fees, important terms, and hidden details are very important in order to minimize unpleasant surprises while using Venmo to send and receive money. Because of this, we decided to delve into it a little deeper to highlight some key information that you may have missed, to give you a better understanding before opening a Venmo account on your smartphone.

Available for Android & iOSBy far, the biggest reason for Venmo's popularity is its availability to a broad range of users. Unlike Apple Pay, Venmo is one of the few peer-to-peer payment apps that's available for both iOS and Android, and it has high ratings from users of both platforms due to is reliability and user-friendliness. Best of all, Venmo is free to install, so give it a try if you hadn't already done so.Install Venmo: Android | iOS In order to use Venmo, an iPhone will have to be on iOS 10 or above, and an Android phone should be running Android 4.1 Jelly Bean or higher. Otherwise, Venmo will not run on you smartphone.

Residency & Age RequirementsTo use Venmo, you must be at least 18 years old for legal purposes. You can also use the platform to send and receive money from friends and family, as long as you reside in the United States. Some limitations may apply depending on your residency status, however, so check out the following sections for more details.

You May Need to Verify Your IdentityAs a business that deals with money transfers, Venmo is subject to regulations imposed by the United States Treasury Department and can ask you at any time to verify your identity. And while you can sign up and use Venmo without providing any personal details, doing so places some limits.By far, the easiest way to verify your identity with Venmo is to sign up using your Facebook account. Despite that, however, Venmo may still ask you to provide your social security number or other documentation if you either send more than $299.99 in one week, withdraw more than $999 in one week, or create a group account. In verifying your identity, Venmo may ask for the following:your full name your birthday your social security number your driver's license or state ID your home address (not a PO box) answers regarding your personal history

Transaction LimitsWithout identity verification, Venmo places a $300 weekly rolling limit on your transactions. This means that for every seven days, you can't have more than $299.99 in transactions each week. This limit kicks in the moment you conduct your first transaction, so if you send or receive $100 at 12 p.m. on a Tuesday, you'll have a remaining limit of $199.99 until precisely 12:01 p.m. on the following Tuesday.If your identity is verified, Venmo raises your weekly rolling limit to $2,999.99 for sending funds, though they make no mention of how much you can receive. Your sending limit further increases by $2,000 when either making payments to authorized merchants or using your Venmo card for transactions, making for a combined total of $4,999 a week. You are only limited to 30 authorized merchant payments a day, however, so keep that in mind.

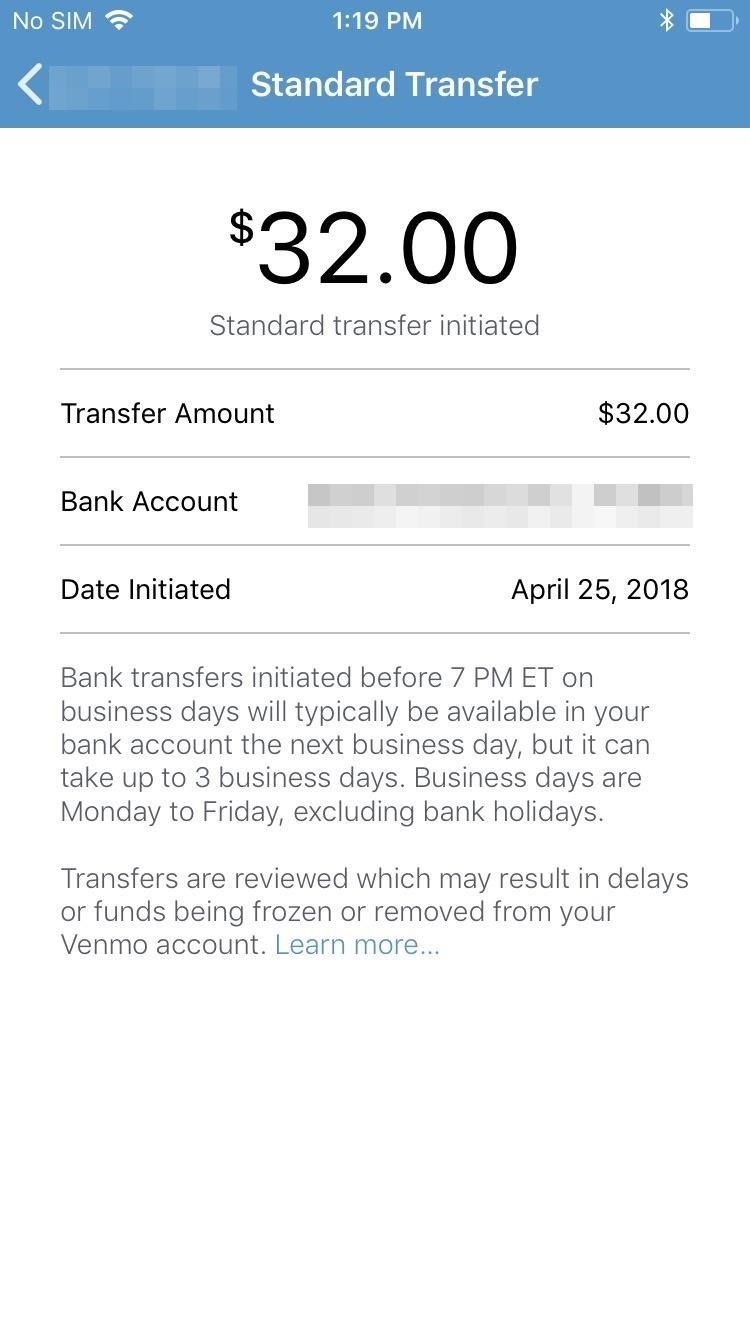

Fees for Sending & Withdrawing FundsAs far as payments go, Venmo lets you send money to friends and loved ones free of charge unless you use a credit card to fund your transaction. For the latter, Venmo charges you a flat 3% fee. So if you use a linked credit card to send a friend $100 for his or her birthday, Venmo will tack on a 3% fee on top of the money you've sent and charge your credit card $103 in total.Don't Miss: How to Send Money to Friends & Family with Venmo When it comes to making withdrawals, Venmo gives you two options — standard or instant. Standard withdrawals process slower but are free of charge, while instant withdrawals have a flat fee of $0.25 and posts to your bank account on the same day. Standard transfer (left) vs. instant transfer (right).

Time Before Funds Are Available When Transferring to BankVenmo states standard withdrawals will post to your bank account usually within one business day, as long as you initiate the transfer before 7 p.m. Eastern Time. Of course, business days don't count the weekends and bank holidays, so if you withdraw money to your bank account at noon on a Friday, your funds won't post into your account until Monday. And if Monday turns out to be Labor Day, your money won't arrive until Tuesday.As far as time of arrival goes, withdrawals made from Venmo posts into your bank account around 7 a.m. Eastern Time, at least, from my experience. For instant withdrawals, the funds arrive much faster and usually appears in your bank account within minutes of initiating the transfer.If you don't see the Venmo transfer in your bank account after three full business days, you could have either entered the wrong banking information or the bank rejected the transfer for some reason. (More on invalid bank accounts.)

Venmo Reviews Some Transfers to BanksHowever, in response to an FTC complaint against Venmo, the company now makes it clear that all transfers from your Venmo balance to your bank account are subject to review. This is to prevent suspicious or illegal activity (discussed later on in this guide) and to make sure both sender and recipient of funds in question have complied with Venmo's user agreement.According to Venmo, conducted reviews may or may not result in:delayed, blocked or canceled transfers; funds being held by Venmo; funds being applied to a negative Venmo account balance or used to offset loss incurred by Venmo; account suspension or termination; funds being seized to comply with a court order, warrant or other legal process; and/or funds you previously received being reversed (i.e., sent back to the sender's Venmo balance or to the card or bank account that was used to fund the payment).

— Venmo

Balances & DeductionsIn a nutshell, your Venmo balance consists of funds that you've received from friends and family that hasn't been transferred to your bank account. Once you initiate a transfer, be it a payment to a friend or a withdrawal into your bank account, the amount is automatically deducted from your Venmo balance.So if you transfer $10 out of your Venmo account on the weekend, that money will be automatically deducted from your total balance, even if the funds don't post into your bank account the following Monday. In other words, deductions from you balance happen instantaneously when making withdrawals and aren't deducted at the time the funds arrive in your bank account.

Making Partial PaymentsVenmo doesn't support automatic partial payments and leaves it entirely up to you to conduct them manually. For instance, if you owe a friend $15 for lunch and only have $11 in your Venmo balance, Venmo will automatically deduct the whole $15 from your primary funding source.If you want to use the $11 that's available in your Venmo and have your bank account cover the rest, you'll need to send two separate payments — $11 from Venmo, and $4 from your bank account — to the same recipient. Needless to say, it's important to stay on top of your Venmo balance and conduct transactions carefully to avoid potential overdrafts to your bank account.

Offers Some Protection from Fraudulent ActivityVenmo offers some protection against unauthorized or erroneous transactions. Under Section D.11 of the user agreement, Venmo gives you a 60-day window to report any suspicious activity to be eligible for 100% protection, and it warns that any losses that aren't reported in that timeframe may not be retrievable. According to Venmo:If you do not tell us within 60 days after the account statement was made available to you, you may not get back any money you lost after the 60 days if we can prove that we could have stopped someone from taking the money if you had told us in time.

— VenmoThat said, it's essential to regularly check your Venmo account — even if you don't use the app often — to make sure it's free of any irregularities. Also, keeping your Venmo as secure as possible can't be stressed enough to keep potential hassles at bay.

Not Insured by the FDICAs a company that specializes in peer-to-peer transactions, Venmo falls under the category of non-banking institutions akin to prepaid debit cards. Because of this status, Venmo isn't legally required to be federally insured. This means that funds stored within your Venmo account aren't covered by the FDIC, leaving you with no way to recover any funds stored within your account if the company ever goes belly up.If your Venmo account is tied to your debit card or bank account as its funding source, however, FDIC protection for Venmo is a non-issue since your bank already has you covered. So if you rely on Venmo to send and receive money from friends and loved ones, we recommend transferring most if not all your Venmo balance to your bank account for maximum security.

Venmo Keeps Tabs on Your AccountVenmo has some restrictions with regards to sending and receiving money to help clamp down on illicit activity. Throughout its user agreement, Venmo states that it has the power to monitor your account and keep track of your transactions to make sure you're not using it for purposes that fall under what's prohibited."Restricted Activities" and "Acceptable Use," which can be found under Section D.12–13 of the user agreement, cover a wide array of activities and businesses, such as gambling, online abuse, illicit drugs, pornography, and pyramid schemes, to name a few. Violating this can result in the sudden suspension or termination of your Venmo account.

Be Careful Who You Deal WithVenmo also reserves the right to investigate your account and freeze funds if it believes you've conducted a suspicious transaction — whether you knew it or not. This can include receiving a payment from a hacked Venmo account, a stolen credit card, or a compromised bank account.Also, sending payments to someone who's neither an authorized merchant nor a friend for goods and services can cast you under Venmo's spotlight and potentially lead to your account's suspension or worse. And while it can't freeze your bank account, Venmo can freeze the funds that are withdrawn from it for transactional purposes, so always be on alert with regards to who you deal with while using Venmo.Without a doubt, Venmo is currently one of the best peer-to-peer money transfer apps out there, and its ease of use and popularity more than makes up for its comparatively minor limitations. How are you liking Venmo? Is there another app out there that you think does a better job? As always, don't forget to share your thoughts by posting in the comment section below.Don't Miss: More Venmo Tips to Help You Use the Mobile App Like a BossFollow Gadget Hacks on Facebook, Twitter, YouTube, and Flipboard Follow WonderHowTo on Facebook, Twitter, Pinterest, and Flipboard

Cover image and screenshots by Amboy Manalo/Gadget Hacks

How To: Get the New Clock & Camera Apps from Android O on Your Nexus or Pixel How To: Samsung's Hidden App Lets You Drastically Change Your Galaxy's Look How To: Get Quick Access to Almost Any System Function on Your Android How To: Access Widgets from Anywhere on Android

How to Add Quick Settings Toggles to the Notification Tray on

On iTunes I paid for Beatles songs that were labelled as ringtones. I changed the extension to .m4r on a couple but they are too long to be used as ringtones. How do I take a chunk of a song and convert it (shorten it) suitably to be used as a ringtone? I am using a Mac computer.

How to Convert Songs in iTunes: 6 Steps (with Pictures) - wikiHow

We will cover each of these methods (in varying levels of detail) in the four sections below. So skip down to the section that fits your device, version of Android, and situation. How to Unroot Basically Any Android Device with SuperSU. SuperSU is easily the most popular and robust root management app available on Android.

How to root Android phones and tablets (and unroot them)

Hi, you're watching VisiHow. Today I'm going to show you how to switch between satellite and terrain view on Google Maps on an iPhone 6.

Download Google Maps on a BlackBerry | HowStuffWorks

When you get control of your data you can save big on your cell phone bill. We'll show you how to restrict background data on your Android phone and cut any lingering cellular charges from your bill. We'll talk a bit about what background data is and how to block apps from accessing the Internet.

Block apps from accessing the Internet on Android device

Android's quick responses let you send a text message to a caller when you can't answer the phone. Customize them quickly and easily. How to change text message quick responses on Android Lollipop

A new record label from international artist, Lange. Expect a grooved techno-edged output ranging from the progressive to aggressive.. 107 Tracks. 1009 Followers. Stream Tracks and Playlists from Create Music on your desktop or mobile device.

How to Discover New Music and Underground Artists Online

The Samsung Galaxy Note 8 has a feature that allows you to view multiple apps in split screen multi-window mode. Here's how to enable it. Android Pie. Open the apps you wish to use as you normally would. Note: The app must be one that supports multi-screen. Otherwise, you will get a message that the app "does not support split screen view".

How to Enable Split Screen for Any App in Android Nougat

How Thieves Bypass the Lock Screen on Your Samsung Galaxy Note 2, Galaxy S3 & More Android Phones IFTTT 101: How to Use Widgets to Control Your Favorite Applets on iPhone or Android How To: Remove the Lock Screen Camera Shortcut on Your iPhone in iOS 10

Here's a simple tip that I just figured out myself the other day: hide your online status on Facebook! Why is this useful? Well, now that Facebook has built chat into the online interface (kind of like Google Hangouts running inside Gmail), your friends can start chatting with you any time you log into Facebook.

Keep Your Online Status a Secret on Facebook - Lifewire

On the System UI Tuner page, turn "Show embedded battery percentage" on. Your battery icon will now display your level of charge at all times. How to Show Your Battery's Percentage in Android KitKat and Lollipop. KitKat and Lollipop actually have this feature built-in, but the setting is even more hidden.

Android 6.0 Marshmallow: How to enable battery percentage and

How To: Turning Video Clips into High-Quality GIFs Is the Easiest Thing Ever with Imgur Raspberry Pi: Physical Backdoor Part 1 How To: Produce and mix hip hop drums in Avid Pro Tools 9 How To: Use the Transport tool in Pro Tools SE

Unfortunately, there are no magical ways to make the ultra-sonic fingerprint scanner work faster on the Galaxy S10; however, there's always a possibility that Samsung can roll out an update

How To Improve The Speed Of Fingerprint Scanner On Your

On your iPhone, go to the Settings app. Tap your name at the top of the screen (in iOS 9 and earlier, skip this step). Tap iCloud. Move the Notes slider to on/green. Repeat this process on every device you want to sync notes via iCloud.

Apple's iPhone 5 User Guide Tells You Everything You Need To

0 comments:

Post a Comment